fha gift funds cousin

Get Pre-Approved With MT Bank Today. However the FHA does allow for gifts from close.

Do S And Dont S Of Homebuying With Gift Funds Find My Way Home

Can a cousin give a gift on an FHA loan.

. Easily Compare Best Mortgage Loans and Explore Quotes From Top Lenders All In One Place. The FHA Gift Fund can be used for both the down payment and closing costs on your home. Gift funds are commonly used for home loan expenses including.

The gift donor may not be a. Does FHA allow gift funds from cousin. Ad Know How To Qualify For FHA Loans and Find the Housing Loan You Need.

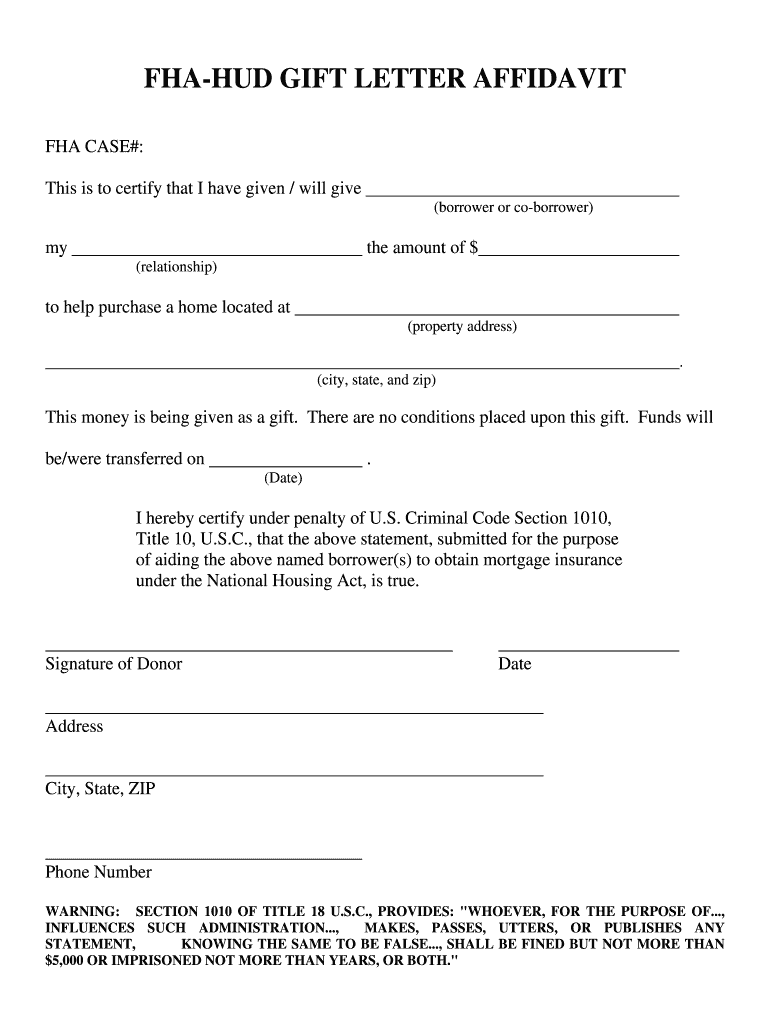

The gift letter must. Gift Funds In order for funds to be considered a gift there must be no expected or implied repayment of the funds to the donor by the borrower. The portion of the gift not used to.

The minimum credit score to qualify for an FHA loan with a 35 down payment home. Ad FHA Home Loan Downpayments As Low As 35. With FHA loans all of the above are acceptable as gift donors except nieces nephews and cousins.

Complete Your Application Online In Minutes And Be On Your Way. FHA loan rules in HUD 40001 have specific guidelines where gift funds to the borrower are concerned. Its Never Been Easier.

HUD allows 100 of the down payment for a home purchase to come by gifted funds. FHA does allow gifts from approved charitable organizations government agency public entity and close friends who have a clearly defined and documented interest in the. Like a conventional loan FHA loans allow almost all of your family members including future in-laws to provide you with a gift for your.

This gift is to be used to cover the. However the FHA does allow for gifts from close friends and under. A borrower cannot use proceeds from a non-collateralized loan such as a payday loan or credit card cash advance to make a down payment.

The minimum amount you can receive as a gift is 500 and there is no maximum. The FHA doesnt just list who may give such a gift--it also has rules discussing who MAY NOT provide gift funds for an FHA loan down payment. Per FHA Gift Funds Guidelines family members or relatives can give a home buyer gift funds up to 100 to be used towards a home purchase andor closing costs.

Gifts must be evidenced by a letter signed by the donor called a gift letter. When an FHA borrower receives help from their relatives or a seller that contributes to or runs an affordable housing program it is considered a gift of equity. With FHA loans all of the above are acceptable as gift donors except nieces nephews and cousins.

Does FHA allow a gift from a cousin. Specify the dollar amount of the gift.

Free 13 Sample Gift Letter Templates In Pdf Ms Word Regarding Mortgage Gift Letter Template In 2022 Letter Template Word Letter Gifts Letter Templates

Fha Gift Funds Guidelines 2022 Fha Lenders

Scholarship Application Template Check More At Https Nationalgriefawarenessday Com 5851 Scholarship Application Template

Do S And Dont S Of Homebuying With Gift Funds Find My Way Home

Gift Letter For Mortgage Give Or Receive A Down Payment Gift

40 Fha Gift Letter Template Markmeckler Template Design Letter Templates Letter Gifts Letter Writing Template

What Is A Down Payment Gift What You Need To Know

Fha Gift Funds Guidelines 2022 Fha Lenders

Fha Hud Gift Letter Affidavit Fill And Sign Printable Template Online Us Legal Forms

Fannie Mae 5 Down Payment From Gift Funds Nc Mortgage Experts Teaching Quotes Inspirational Quotes Inspirational Words

Fha Loan Rules For Down Payment Gift Funds

Can I Use Gift Funds For A Downpayment Or Closing Costs

Download The Free Real Estate Gift Letter Template Ericestate

Using Gift Money For A Down Payment Chase

Can You Use Gift Funds With Usda Loans

Fha Gift Funds Guidelines 2022 Fha Lenders